Allbirds Tree Lounger: A Comfortable, Breathable Summer Slip-on Shoe

Written by Barking Dog contributor, Nathan R.

Pros:

- Easy to slip on and off hands free or with the heel flap

- Breathable so your feet do not get super sweaty, therefore little to no stink– no socks needed!

- Comfortable insole for relatively good support especially in the arch and heel of the foot

- Machine washable

Cons:

- Only come in whole sizes (If you have wide feet then toe box may be snug and will have to go up a size which may cause problems with feet sliding around or less support in the heel)

- If you have a bunion, then it’ll show through the thin mesh layer of the shoe

- Will take some time to break in the shoe (amount of time may vary)

For me, breathable shoes are an essential during the summer months. Yet, having spent the last 5 months recovering from an achilles tear on my right foot, comfort and support are also top priorities for me. To cope with these issues, I was introduced to the Allbirds tree lounger. From my initial understanding of the shoe, I was a little hesitant given my concerns on the level of support a slip on shoe could provide and whether the brand itself was worth the praise it has been given. However, give me a chance to explain why the Allbirds tree loungers are a good option to have in your closet for $95.

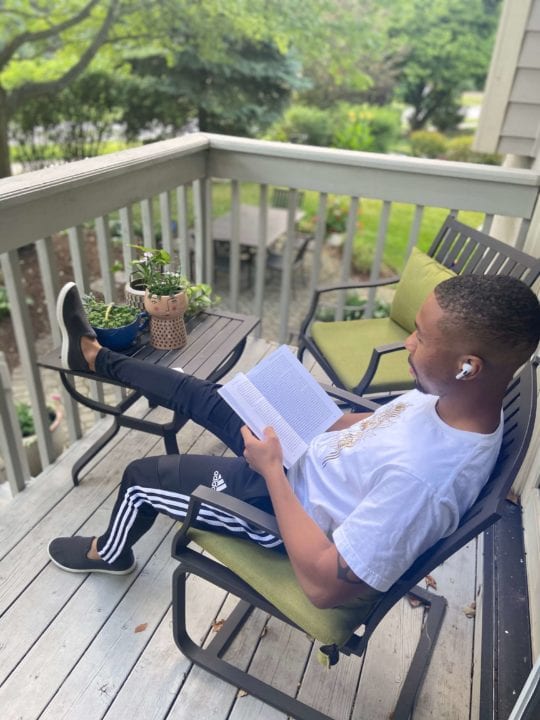

The Allbirds tree lounger is a very minimalistic shoe at first glance. A monochromatic color for the upper with a white sole. Nothing super impressive but makes it easy to pair with almost any summertime outfit. It has a very simple and sleek design. No fancy embroidering of the logo, no fancy stitching, no crazy pattern on the sole (not even so much as different color shoe laces), just a simple, low profile slip on shoe with the name brand on the back of the heel and logo on the heel flap. The tree lounger comes in two colors: charcoal and kauri marine blue, both with white soles. With this in mind, a number of comfortable, casual outfits are very much possible with these shoes– you can happily ditch the socks and I’ll expand on this later.

Once out of the box, there’s not much to getting the tree lounger on your feet. You can either slip them on your feet hands free, or use the heel flap to help put them on (I recommend the latter to better protect the longevity of the shoe).

For me, the shoe fits great! I ordered a size 8, but was worried about the width of the shoe since I tend to have wide feet. Yet at the moment of truth, the tree lounger fit almost like a glove. The heel was snug on my foot (this would become a slight problem later after excessive walking), the mid section of the shoe hugged my foot and the toe box left enough room so that my feet were not poking out, but not enough room so that they were sliding around. Warning: Allbirds shoes only come in whole sizes. The website says that their shoes fit true to size. However, if you are in between sizes, they recommend that you go a size up. Those with wide feet may find it difficult to find the right size so bear that in mind when considering an Allbirds shoe.

However, shoes are not meant to just be pretty on your feet. They have to be functional too. They have to be usable–otherwise, they might as well stay on a shelf and collect dust in someone’s shoe collection. The day after getting the Allbirds tree lounger in the mail, I had the chance to really put the shoes to the test.

I spent the afternoon and evening in downtown Chicago with some friends and my brother. I noticed right away that these shoes would require some time to break in. It did not take long for a blister to form above the heel flap on my right foot. As I mentioned earlier, I have been recovering from an achilles tear and when you receive surgery on a tear, the tendon tends to swell up bigger than it was pre-rupture. With that in mind, I knew that the shoe might be a little more snug on the heel but I was not expecting a blister to form. Then I noticed that as the day progressed, my heel felt more sore. Again, I’m still getting used to walking greater distances so I attribute this more toward fatigue of the tendon rather than the shoe itself. I think the materials in the insole helped alleviate the soreness I felt in my heel and helped cushion each step as I navigated the concrete jungle for the first time since quarantine began. There is some padding in the heel so the shoe is not completely flimsy and makes the back sturdy for above average support, especially for a slip-on shoe.

It’s also worth noting that it did rain for a majority of my time in the city and for the time I spent either trying to get out of the rain or getting to my car, the tree lounger absorbed little to no water. I noticed that the upper was barely damp, meaning the sole and more importantly my feet remained dry. Overall, it took about a day and a half for me to break the tree loungers in and once I did, I was able to enjoy the comfort and craftsmanship that had been put into these shoes.

The last thing I had to test out was how well the tree loungers held up in the wash. This is a pretty big claim to fame of the Allbirds product. I was not expecting the shoes to need a wash after my day in the city, but I did step on a berry or two while I was in a more residential area. I felt this was as good of an excuse as any to throw them in the wash for a test run. After running them through the washer, I found that the tree loungers held up well. Although there was not a night and day difference as far as cleanliness of the bottom of the shoe, the washer removed the stain from the berry juice and some of the dirt from the bottom.

Overall, the Allbirds tree lounger is a good buy for the warmer months of a year. For $95, you get an easy to put on shoe that you can dress down with, with a level of comfort you may not get in most other canvas/ slip on shoes at this price range. Need to run to the store, slip on the tree lounger. Going out with some friends– while still practicing social distancing– slip on the tree lounger. Going for a walk in the park, slip on the tree lounger. Going to walk your dog in that same park, slip on your tree lounger. This shoe will not replace other therapeutic shoes that offer more support, but it does give a satisfactory level of support and is much easier to clean than most shoes I have come across. Keep in mind that like other Allbirds shoes, the tree lounger only comes in whole sizes and may present some difficulty if you are looking for a shoe that fits your foot correctly.

The Allbirds Mens Tree Lounger slip-on is available in whole sizes 8-14 for $95 from Allbirds.com.